Going through a divorce or separation while managing a joint mortgage can be complex, but there are several options available to make the process smoother. You may consider buying out your ex-partner, renting out the property, or selling it and dividing the proceeds.

It’s crucial that both parties continue making mortgage payments until a decision is reached. Missed payments can affect both credit scores. If you’re struggling financially, contact your mortgage lender early, as they may offer temporary relief options. This guide will help you explore the best options for your situation and hopefully lead you to an amicable agreement.

Step 1 – Assessing Your Situation

Before you can make a decision, you need to gather key information about your property, mortgage, and financial circumstances. Here’s what you need to know:

1. Property Ownership – Joint Tenants vs Tenants in Common

When you bought your home, your solicitor likely explained how the property is owned. The two most common types of ownership are:

- Joint Tenants – In this case, you both own the property equally. If one partner passes away, the other automatically inherits their share, regardless of any will.

- Tenants in Common – You each own a specific share of the property, which may or may not be equal. You can pass your share to someone else in your will.

If you’re unsure of your property’s ownership status, check the documents from your house purchase, contact your solicitor, or check the UK Land Registry online for a small fee (£3). You can access the service here.

2. Determining the Property’s Value

Getting an accurate valuation of your property is essential when considering a buyout or sale. You can request a valuation from an estate agent, but if that’s not feasible due to your current situation, there are alternative methods:

- Ask a local mortgage adviser for a rough estimate.

- Use online property platforms like Rightmove to compare similar properties in your area. Input your postcode and search within a 5-mile radius for properties with the same number of bedrooms to get an approximate figure.

3. Understanding Your Current Mortgage

Before making any decisions, it’s important to gather all the relevant details about your current mortgage. You can do this by contacting your mortgage lender. While most lenders will allow you to proceed through security without your mortgage reference number, having it on hand will make the process quicker and smoother.

To find your mortgage reference number, check your paperwork such as mortgage statements or the original mortgage offer. If you can’t locate it there, look at your bank statement next to your mortgage payment, as the reference number is often listed there. Sometimes, the exact mortgage payment amount and payment date may also be used as security questions during your call with the lender, so have these details ready.

- Call your mortgage lender to get up-to-date information on the following:

- Mortgage balance

- Monthly payments and interest rate

- Type of mortgage (fixed or variable)

- If you are tied into the mortgage, when does this tie end?

- Early repayment charges and whether the early repayment charge changes during the tie in period

- Any potential penalties for exiting the mortgage early

- Options available if you struggle to make payments alone

Step 2 – Reviewing Your Options

Once you understand your mortgage terms, the property value, and ownership structure, you can start thinking about your next steps. Consider the following options when separating from a joint mortgage:

1. Buying Out Your Partner

This involves purchasing your ex-partner’s share of the property, allowing you to remain in the home. This option avoids estate agent fees and moving costs. If children are involved this option could avoid additional disruption for them, by staying in the same home.

2. Being Bought Out

Alternatively, your ex-partner may buy your share of the property, allowing you to move on while receiving your share of the equity.

3. Selling the Property

Selling can allow both parties to move on, dividing the proceeds of the sale. However, there are additional costs involved, such as estate agent and solicitor fees. You may also incur an early repayment charge if you’re still within a fixed mortgage period. It’s worth noting that you can avoid this charge by transferring the mortgage to a new property. It is possible to transfer a joint mortgage and change it to a sole mortgage at the same time, should you pass the affordability assessment.

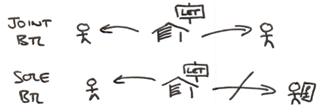

4. Renting Out the Property (Buy-to-Let Mortgage) – Either in joint names or sole name

You may decide to keep the property and rent it out, converting your residential mortgage to a Buy-to-Let (BTL) mortgage. If you choose this option, consider changing the ownership to tenants in common to protect your share. Be aware that you must not live in the property if you switch to a BTL mortgage, as this could be considered mortgage fraud. You may also incur an early repayment charge with this option too if you’re still within a fixed or tied-in mortgage period.

5. Retaining the Property Until the Children Are Grown

Some couples choose to keep the property in joint names until their children have grown up, to minimise disruption in their lives. However, this option requires continued financial cooperation between both parties.

Step 3 – Exploring Financial Options

Calculating the Equity Share

The division of equity can depend on several factors, such as who contributed the deposit, who paid more towards the mortgage, and other assets involved.

Here’s a basic case study to help illustrate:

- Property Value: £250,000

- Mortgage Balance: £140,000

- Early Repayment Charge: 1% of the mortgage balance

- Selling Costs: £5,000

- Remortgaging Costs: £1,000

Here are a few possible calculations:

- Simple Buy-Out:

£250,000 (home value) – £140,000 (mortgage) = £110,000 equity

Ex receives £55,000. - Buy-Out with Costs:

£250,000 (home value) – £140,000 (mortgage) – £1,000 (remortgage costs) = £109,000 equity

Ex receives £54,500. - Considering Selling Costs:

£250,000 (home value) – £140,000 (mortgage) – £5,000 (sale costs) – £1,400 (early repayment charge) = £103,600 equity

Ex receives £51,800.

If one party wishes to purchase the property and buy out the other, this can help avoid significant costs associated with selling, such as solicitor fees, estate agent fees, and any early repayment charges from the lender. When considering the alternative of selling, the couple may find themselves in a better financial position collectively by opting for one ex-partner to buy out the other. It may be reasonable for the buying party to receive a larger share, while the other party receives an amount equivalent to what they would have received if the property had been sold.

What If You Can’t Afford to Buy Out Your Ex?

If you can’t afford to buy out your partner, there are still options available:

- Joint Mortgage with a Family Member or Friend – You could bring in a family member or friend to help with affordability. However, be mindful of additional costs, such as Stamp Duty Land Tax if they own another property. Some lenders may not allow someone to join you if they do not plan to live in the property from completion.

- Guarantor or Joint Borrower Sole Proprietor (JBSP) Mortgage – A guarantor or JBSP mortgage allows someone else to join the mortgage without being added to the property’s deeds. This could help boost your affordability, but independent legal advice is recommended for anyone wishing to join you on a mortgage using this method.

- Receiving Gifts from Family – Family gifts can help boost your deposit, but be aware that gifts could affect any divorce settlement. Speak to a solicitor before proceeding with any large financial gifts if you are married.

Step 4 –Other Financial Considerations

Children and Child Maintenance

1. Agreeing on Child Maintenance

You can use the government’s child maintenance calculator to determine how much should be paid to support your children.

2. Including Child Maintenance in Mortgage Affordability Some lenders will consider child maintenance payments when assessing your affordability for a mortgage. Typically, lenders require three months of evidence, however, the agreement type (court-ordered, CMA, or private) may influence how soon the payments can be counted. In the case of court-ordered agreements, payments could be considered from right away.

Financial Associations and Credit Reports When you have a joint mortgage or joint bank account, a financial association is recorded on your credit file. Even after closing all joint accounts, this financial link can remain. You can request credit agencies such as Experian, Callcredit, or Equifax to sever this association once the accounts are closed.

Need Help? We’re Here for You

If you’re facing the challenges of dealing with a joint mortgage after a breakup, our expert mortgage advisers are here to assist. We offer free, no-obligation appointments tailored to your circumstances, helping you navigate the complexities of joint mortgages through separation, and your future housing options. It’s never too early to have these conversations, and please don’t be concerned if you are unsure how you wish to proceed.

Give us a call on 01778 428158, or book online with one of our friendly advisers.

Helpful Resources:

- Citizens Advice: Deciding what to do when you separate

- Government: Separating or divorcing: what you need to do

- Money Helper: Protecting your home ownership rights during separation